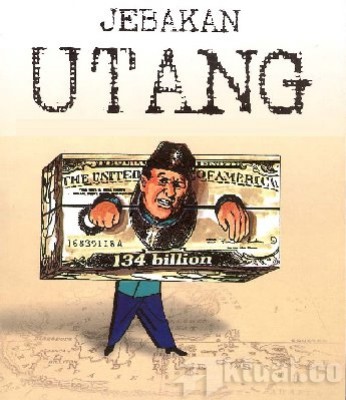

Jakarta, Aktual.com-Member of Commission XI of the House of Representatives Heri Gunawan said President Joko Widodo is not serious in dealing dependence Indonesia with foreign debt, it indicates the fragility of nation economic foundation.

Such conditions are particularly worrying in Indonesia is currently experiencing a global recession.

“The volatility of Indonesia to the turmoil in the global economy because Indonesia is highly dependent on funding from abroad,” said Heri in DPR, Jakarta, Wednesday (3/2).

As a result, the country has always frightened by the global economic turmoil that ultimately led to the capital outflow of the country is very heavy.

Heri reminded, although fundamentally economic condition in Indonesia is quite good, the government should not underestimate the conditions of view the national economy in 2016. At the very least, there are some things the government should be alert in the face of economic movement in this year.

“First, the government needs to look at the exchange rate depreciated returning after fall of 11 percent in 2015. The weakening of the rupiah was an impact on the lack of investment interested,” said Heri.

Moreover, he added, not least the government should give serious attention to the External Debt (ED) Private Indonesia amounted 167.5 billion US dollars.

“It should be noted Jokowi, why private debt is much higher than the government’s foreign debt. Debt it would give heavy pressure on the exchange rate when the Fed raised interest rates, “he said.

The government needs to give serious attention to capital outflow of foreign investors in Indonesia’s stock market, which reached Rp2,32 trillion.

“Much higher than the Philippine capital outflow amounted Rp596,7 billion. This indicates that the negative perception of and in the markets trusting, “he concluded.

For that, the Government should be wary of capital inflow in the bond market. Throughout January 2016 foreign investors recorded a total capital inflow to Indonesia amounted Rp18,95 trillion.

That figure, said Heri, beyond the capital inflow by foreign investors in Malaysia amounted Rp10,32 trillion, trillion Rp8,68 Philippines, and Thailand Rp15,72 trillion.

In addition to the above issues, Heri also reminded that foreign holdings of Government Securities (SBN) should be administered with caution.

“Noted, foreign ownership of government securities that can be traded increased from Rp558,65 trillion on January 4, 2016 became Rp576,58 trillion on January 28, 2016,” he explained.

He asserted, market intervention by BI must be tightly controlled, considering the foreign exchange reserves are running low and the potential distortions in the money market. Then, who should be taken seriously by the government of the future national, growth of economic will depend on government spending and investment.

“During this time, the economy was helped by the concentration of capital in infrastructure development, which is actually also financed by debt. Not only that, the government should respond to the global economic slowdown trend which is continues, marked by a decline in commodity prices and China’s economic with turnaround is likely to strengthen its domestic economy of Tiongkok.

This is a sign that the future of the national economy should not expect much on the external market, “he explained.

Heri added that the decline in prices of world oil exceeded $ 30 / barrel is also a strong signal that the Budget 2016 should be immediately corrected.

“All the assumptions built must be immediately corrected. If not, then the whole national economic targets could be stalled, even threatened not materialize.

Artikel ini ditulis oleh: